If you want to forecast the project cost for the completion of the entire project, you will need the indicators “estimate at completion (EAC)” and “to-complete performance index (TCPI)”. Both are part of the data analysis techniques of the control costs process in the PMI’s Project Management Body of Knowledge (PMBOK®, 6th edition, p. 263-265). They are not only frequently used as indicators in project forecasting but also common for questions in a PMP exam.

This article covers the definition of EAC and the 4 approaches suggested by the PMI, supplemented with the respective formulae and examples. You can also use our EAC calculator to further familiarize yourself with the calculation.

If you intend to calculate indicators that reflect the actual status of your project, read our article on schedule performance index (SPI) and the cost performance index (CPI) and use the free CPI / SPI calculator.

- The Overall Concept of Cost and Schedule Forecasting

- What is the Estimate at Completion (EAC)?

- Estimate at Completion Formulae

- Examples of a Project Situation

- 1) Calculating the EAC with an Estimate to Complete (ETC)

- 2) Calculating the EAC Assuming that the Project will Perform at the Budgeted Rate

- 3) Calculating the EAC with the Present Cost Variance (CV) / Cost Performance Index (CPI)

- 4) Calculating the EAC with the Present Cost Performance Index (CPI) and Schedule Performance Index (SPI)

- Takeaway Points

The Overall Concept of Cost and Schedule Forecasting

When you are in doing project controlling in the course of a project you usually want to know

- Development of actual cost vs budget

- Work performed in relation to the work planned

Both questions can be answered using the schedule performance index (SPI) and the cost performance index (CPI).

However, these indicators focus on the past and current situation. For the forecasting of future project performance, EAC and TCPI the indicators of choice. Both will help you answer the questions:

- What is the amount of expected cost at the completion of the project?

> Can be calculated using the EAC and assuming different scenarios. - How much more/fewer efforts are necessary to complete the project in time?

> Can be calculated using the TCPI.

In this article, we will explain the concept of the EAC, illustrated with several examples.

What is the Estimate at Completion (EAC)?

The EAC is a calculation method to estimate the total cost of a project at its completion when a project has already been started. It corresponds with the budget at completion (BAC) which is the estimate of the total cost (before management reserve) in the planning phase. While the BAC is entirely based on assumptions and estimates, the EAC takes already incurred cost and earned value into account. In addition to these observed values, the estimate to completion (ETC) is added, i.e. the estimated amount of expected work and/or cost required to complete the project.

Before the EAC is calculated, an assumption or estimate on the further development of the project cost and schedule needs to be made. The PMBOK suggests 4 basic assumptions:

- An estimate to complete assumption

- The project will perform at the budgeted rate

- The future performance will be in line with the present cost variance (CV) and cost performance index (CPI)

- The future performance will be in line with the present cost performance index (CPI) and schedule performance index (SPI)

Estimate at Completion Formulae

The formulas to calculate the EAC based on these 4 approaches are:

- EAC with bottom-up ETC: EAC = AC + ETC

- EAC with ETC at budgeted rate: EAC = AC + BAC – EV

- EAC with ETC based on present CPI: EAC = BAC / CPI

- EAC considering CPI and SPI: EAC = AC + ((BAC-EV) / (CPI x SPI))

AC = Actual Cost, ETC = Estimate to Complete, BAC = Budget at Completion, EV = Earned Value, CPI = Cost Performance Index, SPI = Schedule performance Index. If you are not familiar with these terms, check our table that presents the input parameters for EAC and their respective definitions.

We will be explaining the different approaches and their formulas below, based on the following simple example.

Examples of a Project Situation

The following two examples represent two different situations: In one case, the project is facing a cost overrun while it is behind schedule. In the other case, it is ahead of the schedule with at less incurred cost than expected. You can use our EAC calculator to calculate the values yourself.

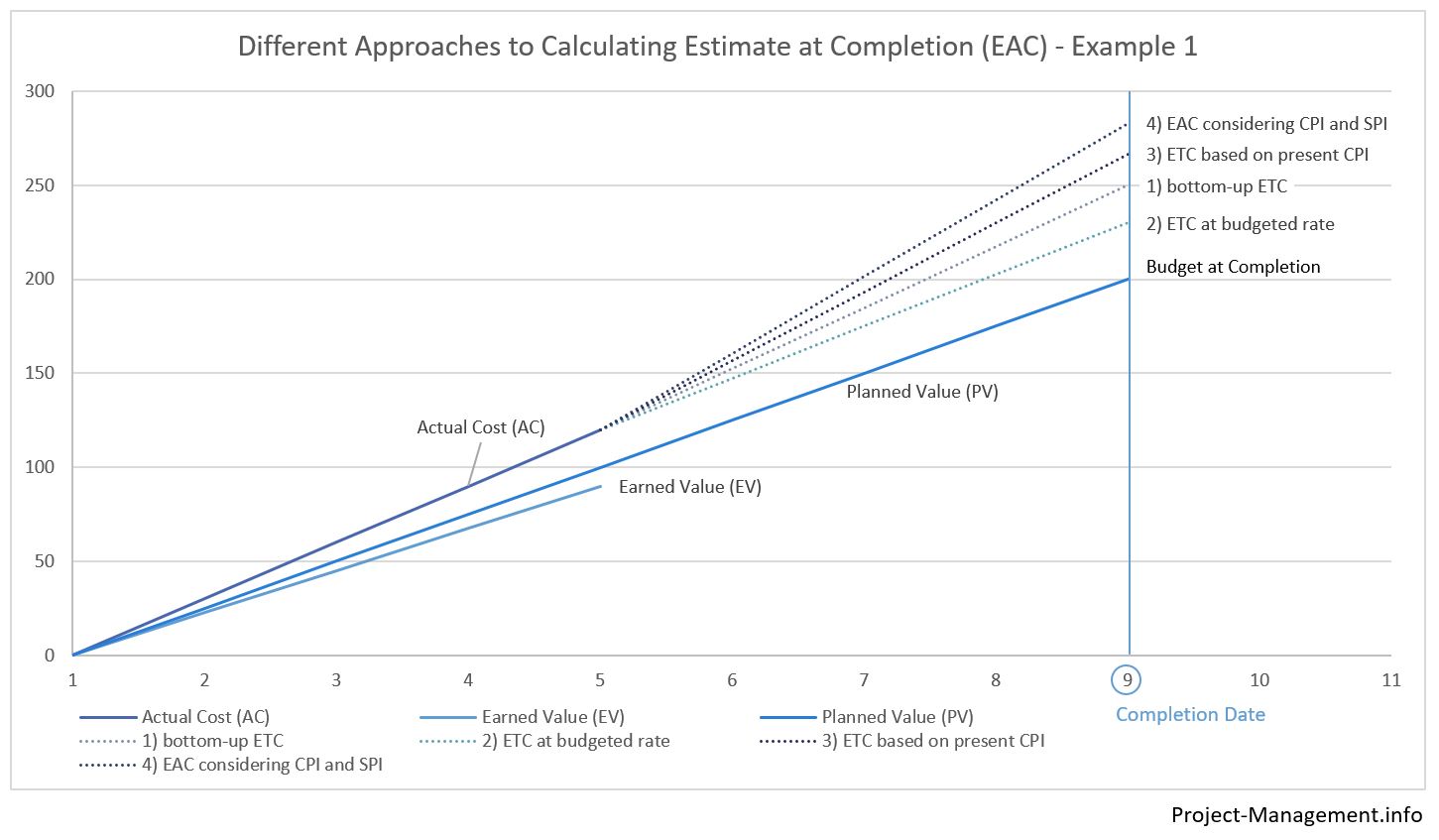

Example 1) Project behind Schedule with Cost Overrun

A project is planned to take 8 months. At the end of the 4th months, the records of the project controlling show the following observed cumulative indicators:

| Actual Cost (AC) | 120 |

| Earned Value (EV) | 90 |

| Planned Value (PV) | 100 |

| Budget at Completion (BAC) | 200 |

The table shows that the cumulative actual cost are 20% higher than expected while the earned value is 10% less than planned. This is a good example of a situation where a re-estimate is sensible, probably in combination with other actions.

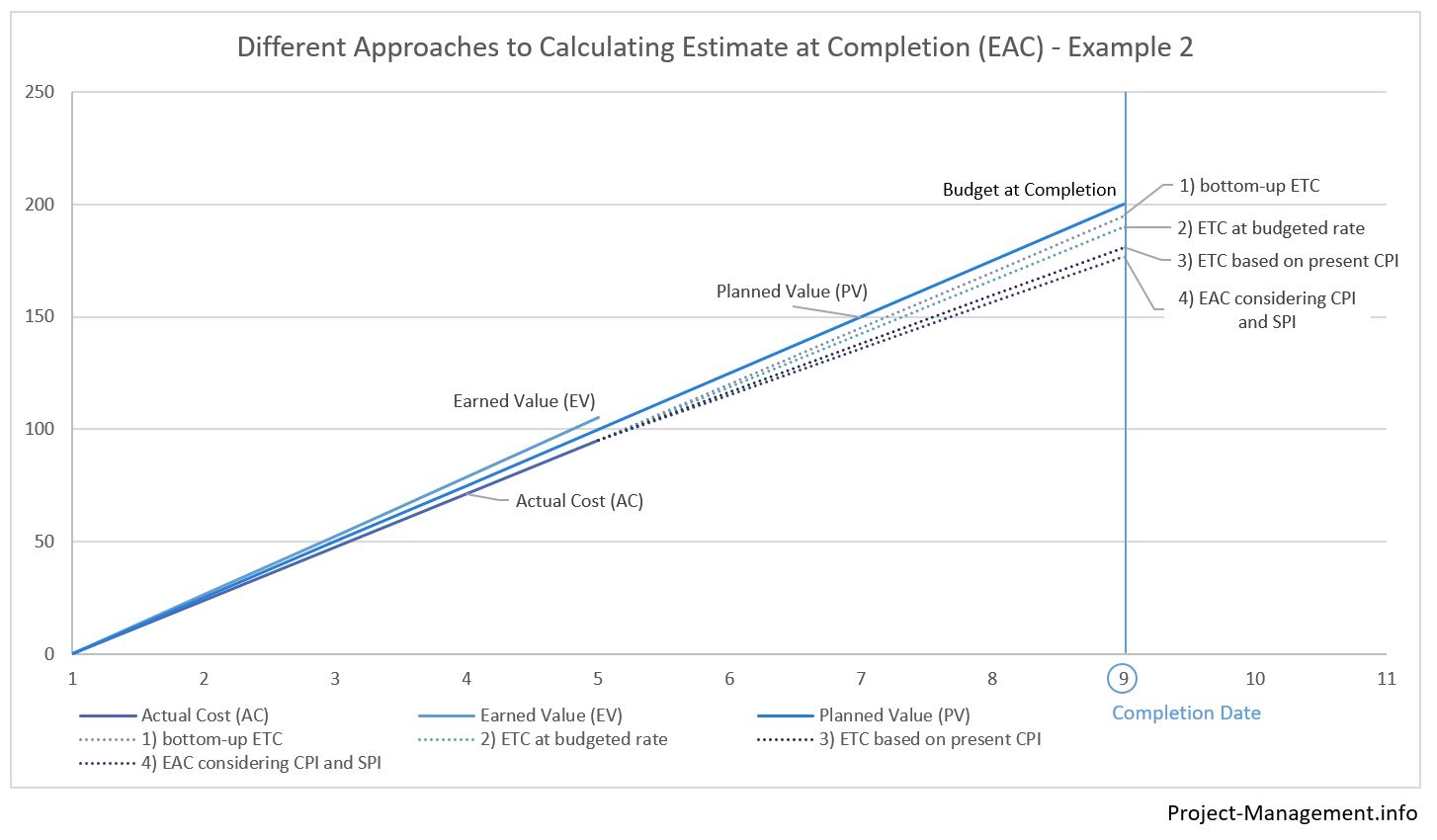

Example 2) Project ahead of Schedule with Lower Cost than Planned

At the end of the 4th month of an 8-month project, the following values of the project controlling indicators are observed:

| Actual Cost (AC) | 95 |

| Earned Value (EV) | 105 |

| Planned Value (PV) | 100 |

| Budget at Completion (BAC) | 200 |

In this situation, the actual cost (AC) value is lower than expected and the earned value (EV) exceeds the planned value (PV).

1) Calculating the EAC with an Estimate to Complete (ETC)

This approach uses the actual cost as basis and adds the estimated amount of work/cost required to complete the project. While the ETC-based calculation has the easiest formula, it probably takes some effort to come up with the estimate itself.

The PMBOK suggests that the estimate be determined with a bottom-up estimation which implies asking the project team to estimate their individual work. While this is likely the most accurate approach, it may also take a lot of time and effort, in particular, if it is a large project or if several rounds of estimates are required. In practice, other estimation techniques are used as well and can be reasonable and appropriate in certain situations.

The output of the estimation is the estimate to complete (ETC) which will then be inserted into the following formula:

EAC = AC + ETC

Example 1 – Calculated with an Estimate to Complete

In this example, the Estimate to Completion (ETC) amounts to 130. Thus, the EAC is:

EAC = AC + ETC = 120 + 130 = 250.

The re-estimated EAC exceeds the planned budget at completion by 50.

Example 2 – Calculated with an Estimate to Complete

In the second example, the amount of remaining work/cost required for the completion of the project (ETC) is 100. The EAC is calculated as follows:

EAC = AC + ETC = 95 + 100 = 195

Based on the previous performance and the update estimation, the project is likely to be completed within (slightly under) the budget at completion.

2) Calculating the EAC Assuming that the Project will Perform at the Budgeted Rate

This approach is selected if the project manager assumes that the project will perform in line with the budgeted rate going forward, regardless of the project’s previous performance. While the calculation considers past budget variances (i.e. cost and schedule variances), it does not take any future variances into account. Thus, the cumulative variances at the time of calculation remain constant until the completion of the project.

The formula is:

EAC = AC + BAC – EV

Example 1 – Forecast with the Budgeted Rate

The budgeted rate is reflected in the BAC while the existing deviations from the planned value are considered by adding the actual cost and subtracting the earned value.

EAC = AC + BAC – EV = 120 + 200 – 90 = 230

According to this approach, the budget at completion would be exceeded by 30.

Example 2 – Forecast with the Budgeted Rate

The calculation is analogous example 1:

EAC = AC + BAC – EV = 95 + 200 – 105 = 190

In this case, the project is expected to be completed within the planned budget.

3) Calculating the EAC with the Present Cost Variance (CV) / Cost Performance Index (CPI)

This approach assumes that the project continues to perform with the present cost variance and cost performance index. The Estimate at Completion is calculated using the following formula:

EAC = BAC / CPI where CPI = EV / AC

or EAC = AC / (EV / BAC) | both formulas with same result

Example 1 – Extrapolation of the Current Cost Variance

If the first option of the formula is used, the cost performance index needs to be calculated before the EAC is determined:

CPI = EV / AC = 90 / 120 = 0.75

EAC = BAC / CPI = 200 / 0.75 = 266.67

Compared to the previous approach, the cumulative variance expands over the remaining time of the project, leading to a forecasted budget excess of 66.67.

Example 2 – Extrapolation of the Current Cost Variance

In this example, the CPI and EAC calculate as follows:

CPI = EV / AC = 105 / 95 = 1.1053

EAC = EAC = BAC / CPI = 200 / 1.1053 = 180.95

Analogous example 1, the use of a constant cost variance (in this case positive) leads to an increasing absolute difference between planned and budgeted values and actual cost. This forecast suggests a remaining budget surplus of 19.05 when the project is completed.

4) Calculating the EAC with the Present Cost Performance Index (CPI) and Schedule Performance Index (SPI)

The CPI/SPI-based approach does not only take the cost variance but also deviations from the planned value (schedule variance) into account, using the cost and the schedule performance index as input parameters. The PMI recommends this approach for cases where schedule variances are significantly affecting the estimate to completion. This could be the case if deferring the completion date would not be acceptable.

The formula of the CPI/SPI-based EAC is:

EAC = AC + ((BAC-EV) / (CPI x SPI))

where CPI = EV / AC

and SPI = EV / PV

Example 1 – Calculated with the CPI/SPI-based Approach

As a first step, the CPI and SPI are determined:

CPI = EV / AC = 90 / 120= 0.75

SPI = EV / PV = 90 / 100 = 0.9

Using the abovementioned EAC formula, the calculation is:

EAC = AC + ((BAC-EV) / (CPI x SPI)) = 120 + ((200 – 90) / (0.75 x 0.9)) = 282.963

All in all, a budget overrun of more than 82 is expected – a significant excess of more than 40% compared to the budget at completion.

Example 2 – Calculated with the CPI/SPI-based Approach

The calculation steps are identical to those for the first example:

CPI = EV / AC = 105 / 95 = 1.1053

SPI = EV / PV = 105 / 100 = 1.05

EAC = AC + ((BAC-EV) / (CPI x SPI)) = 95 + ((200 – 105) / (1.1053 x 1.05) = 176.86

In this forecast, a positive cost variance at completion of more than 23 is expected – the project will be completed at more than 11% under planned budget.

Takeaway Points

The PMBOK suggests 4 different methods to calculate the Estimate at Completion – each of them with their own pros and cons as well as best uses. While a bottom-up ETC may lead to the most accurate estimation, it may also require the highest amount of effort given that the project team needs to be involved in a granular re-estimation of their remaining work. A forecast based on the initially budgeted rate may be appropriate if no significant deviations have been observed in previous periods, or if impediments and reasons for variances have already been resolved. However, the variance at completion (VAC) equals the current cumulative variance if that approach is chosen.

The two remaining approaches extrapolate observed variances in the future – one of them covering the cost variances only while the other method additionally considers schedule variances, using both the cost performance index and schedule performance index. These formulas should be used if no change of the observed variance is expected going forward.

In practice, a project manager might also determine the CPI and SPI for a certain period rather than using the cumulative ones. This is sensible if variances in certain previous periods are not representative for forecasted periods while the use of the budgeted rate would not be reasonable either. For instance, there could have been one-off events in previous periods that should not affect the forecast while the project is however expected to continue to over- or underperform compared to the plan. In such cases, the CPI and SPI could either be calculated excluding that outlier or even estimated by the project manager. Read more in our dedicated article on the CPI and SPI.

If a project manager chooses the calculation method consciously in accordance with the individual situation of a project, the EAC forecasting is a powerful technique for the replanning of a project as well as the corresponding stakeholder communication.

Read more about Earned Value Management in our dedicated article.