Do you need to calculate the number of periods an investment requires to reach the break-even point? The Payback Period (PbP or PBP) indicates the period in which a full repayment or amortization of an investment is achieved. This indicator is used not only for the assessment of project options and business cases in project management but also for the assessment of investment alternatives.

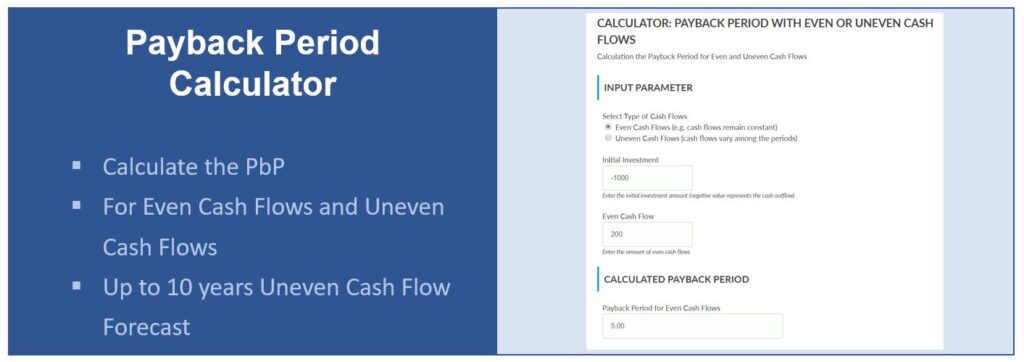

Select whether you are projecting even or uneven cash flows, fill in the initial investment and the forecasted net cash flows. The calculator will determine the period in which the initial investment will be fully repaid and provide you with the accurate Payback Period (PbP) value.

Introduction to the Payback Period Calculator

The Payback Period method is popular for the assessment of project options and investment alternatives. It is a rather lightweight indicator which – thanks to its simplicity – is easy to understand and communicate. The PbP answers the question how much time it takes until the cumulated net cash flows offset the initial investment.

If you compare different project options, the payback period provides useful additional information that supplements profitability-focused indicators such as the net present value and the benefit-cost ratio. The latter indicators are ideal to assess and compare the overall profitability of a project or an investment.

However, they may rely heavily on a residual value or high inflows in late periods while investors and managers often tend to prefer a rather early recovery of their investment amount. The PbP is adding this dimension to the set of indicators used in a cost-benefit analysis. According to the PMI Project Management Body of Knowledge (source: PMBOK®, 6th edition, part 1, ch. 1.2.6.4, p. 34), PbP is one of project success measures.

Input Parameters

The following parameters are necessary for the calculation of the Payback Period.

Initial Investment

The amount of the initial investment needs to be filled in as a negative cash flow (i.e. an outflow). Even if the initial investment is not an actual outflow, e.g. if it consists of internal cost or resources, it has to be treated as a cash flow for calculation purposes.

Projected Net Cash Flows

You will have to input the net cash flows of your financial projection. The calculator can process 2 types of series of cash flows:

- Even cash flows,

- Uneven cash flows.

Even Cash Flows

If the forecast assumes or is simplified in a way that cash flows remain constant over the time horizon of the projection, the radio button “even cash flow” shall be selected. The calculator shows only one input field – the even, constant cash flow for all periods within the forecast.

Uneven Cash Flows

The cash flows of most investments other than financial instruments and deposits are uneven. Hence, the amount of the net cash flows varies among the periods within a forecast time horizon. Also, the cumulative cash flow can move bi-directional, e.g. starting in a negative value range, switching to a positive value and falling back under 0 over time.

If you choose this option, you can populate net cash flows for 10 periods. Note that the calculator determines the PbP based on the first period in which the cumulative cash flow turns positive without taking a change to a negative value range in subsequent periods into account.

The PbP is calculated on an intra-period basis, e.g. a PbP of 4.25 indicates that the break-even would be achieved at the end of the first quarter in year 4.

Calculator for Payback Period (Calculate the PbP Online without Registration)

Chose the type of cash flows, fill in the initial investment and your forecasted even or uneven cash flows. The calculator will then compute the payback period.

Afterword

We hope that you have found this calculator useful. If you are preparing for your PMP or any other exam, you can also use it to validate self-developed examples.

Make sure that you also check out our other calculators, e.g. for Discounted Payback Period, NPV or Benefit-Cost Ratio, and read this comprehensive introduction to cost-benefit analysis. If you have feedback for us or suggestions for new or enhanced features, feel free to share your thoughts with us!