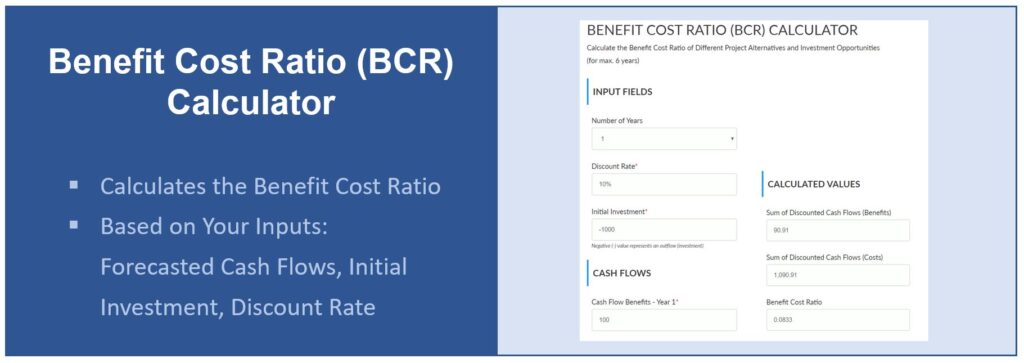

Do you need to compare the value of different investment alternatives, project scenarios or assets? If so, you will find this BCR calculator useful. It calculates the benefit-to-cost ratio based on your cash flow forecast and your discount rate.

Introduction to the BCR Calculator

In cost benefit analyses, the BCR is one of the common methods to assess and compare the future profitability of a series of cash flows (see PMI PMBOK®, 6th ed., part 1, ch. 1.2.6.4, p. 34). It is often used to supplement comparisons based on the net present value. In these cases, the BCR indicates the relation of costs and benefits. It is interpreted as follows:

- A BCR lower than 1 indicates that the series of cash flows is not profitable.

- A BCR of 1 is the result of a present value of the benefits equal to the present value of the costs of a project or investment.

- A BCR greater than 1 stands for a profitable option. Its value increases as the relative excess of the discounted benefits over the discounted costs increases.

Input Parameters

You will need to input the following parameters to calculate the benefit-cost ratio.

Discount Rate

The discount rate is used for discounting the cash flows. Set a rate that is consistent with the requirements of your organization, e.g. capital cost or internal return target, or a risk-adjusted market interest rate. The calculator will apply this discount rate to all cash flows in order to discount them.

Initial Investment

Indicate the initial investment as a negative outflow. This includes all kinds of upfront expenses and costs as well as resources provided by the organization. If your project does not require any upfront investment in the first year, fill in ‘0’.

Note that the initial investment is treated as taking place now (in “year 0”), hence it will not be discounted.

Projected Cost and Benefit Cash Flows

Choose the number of years covered by your projection. The calculator supports processing forecasts over up to 6 years. Fill in the sum of the forecasted benefits and the sum of the forecasted costs separately and for every year in the respective input fields. Make sure that you use the gross numbers of in- and outflows to avoid unintended effects on the BCR results.

If some of your costs or benefits are not cash flows, e.g. use of internal resources, convert them into cash flow equivalents for comparison purposes. The same advice is applicable to non-monetary costs and benefits – they need to be converted into a consistent (currency) unit to ensure quantitative comparability.

The Benefit Cost Ratio Calculator

Fill in the number of periods, the forecasted cost- and benefit-related cash flows, the discount rate and calculate the benefit-to-cost ratio of your project:

Afterword

We hope you have found this BCR calculator useful. Make sure that you do not limit your cost benefit analysis to the benefit-to-cost ratio alone. In addition, you might consider calculating the net present value, payback period and other indicators to get a full picture of the different aspects of your project options.

If you are preparing for the PMP or CAPM exam, you should aim to have a basic understanding of the BCR without allocating too much preparation time though. To facilitate your learning, you can come up with your own examples and validate your results against our calculator.